Minecraft, Crypto, Stocks: Exploring the Intersection of Gaming, Digital Mining, and Smart Investing

By Mark Lyman - Book a Demo!

Don’t like reading? Watch the YouTube video!

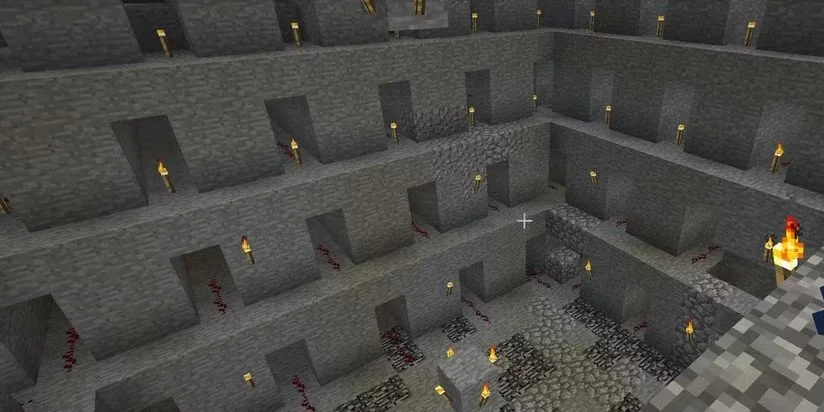

Mining is a concept almost everyone knows - whether it’s from the blocky adventures of Minecraft or the high-tech world of cryptocurrency. In Minecraft, players dig deep into virtual landscapes, searching for rare ores like diamonds that open new possibilities. Crypto miners, meanwhile, harness powerful machines to solve puzzles and unlock digital coins. Now imagine applying that same mining mindset to the stock market: digging through mountains of data, filtering out the noise, and unearthing clusters of hidden profit opportunities like veins of gold.

At first glance, investing and mining might seem worlds apart. Yet, at LymanWealth, we’ve embraced the idea of quantitative mining — an innovative process that leverages technology and data to uncover hidden “diamond clusters” of profitability within vast stock market data. By mining these pockets of opportunity, we create smarter, more resilient investment strategies that don’t rely on luck, but on precision and insight.

Minecraft Mining 101: Strategy Meets Discovery

Think about Minecraft for a moment. Success isn’t about just randomly digging. Players explore systematically, targeting promising caves and veins where valuable ores cluster together. The better your tools and strategy, the more efficiently you find these precious resources.

The LymanWealth investing process follows a similar path. Instead of exploring a virtual world, we explore a complex, multidimensional landscape of investment strategy settings - different risk levels, entry signals, trade sizes, exit points, and more. Each unique combination of these parameters is like a block in Minecraft. Some blocks are dirt or stone - low value. Others are diamonds - representing high, stable, repeatable patterns of profit.

Crypto Mining: Computational Power Meets Precision

Now consider crypto mining, where computers act like digital pickaxes, chipping away at cryptographic puzzles. Each attempt is like breaking a block in Minecraft: most are just dirt or stone, but every so often, the right combination discovers a hidden ore. That “ore” is a cryptographic key that unlocks a digital reward. The process takes persistence, power, and the right tools - just like mining a cave in search of diamonds.

For LymanWealth, our “digital pickaxe” is our quantitative mining process — a system that digs through decades of historical stock market data. Like miners chipping away at rock or a cryptographic puzzle, we break down the data block by block, running millions of simulations across countless parameter combinations. Most of what we uncover is just stone - unprofitable patterns that lead nowhere. But every so often, our process strikes a hidden vein: a strategy of real profitability, gleaming like diamonds, just waiting to be unearthed.

LymanWealth’s Quantitative Mining: Discovering Clusters of Profitability

To make sense of this vast data and parameter universe, we visualize it through a Prism of Profitability - a 3D heatmapped graph where each point represents a unique strategy configuration. The brightness of each point reflects the level of profitability achieved.

And yes, we know it looks like The Tesseract.

Imagine spinning this prism in your hands, zooming in to inspect glowing clusters, and filtering out the dim or erratic points. Some areas glow brightly with consistent profitability, while others flicker dimly or scatter like fool’s gold. It’s like sorting through a rich Minecraft haul, separating the diamonds from the cobblestone, or reviewing the output of the crypto mining process, identifying which blocks yielded digital rewards.

By creating these Prisms of Profitability, we can visualize and interact with the data to uncover dense clusters of high-performing parameters — turning complex quantitative research into an intuitive, tangible view of where stable, repeatable profits lie. This makes the investment process both tangible and exciting.

“Clarity comes not from the abundance of data, but from discerning the patterns that endure.”

Stability Over Speculation

Why focus on clusters? Because they represent stability.

A single bright point might be a fluke — a lucky parameter set that won’t hold up over time. But a cluster of bright points tells us there’s a durable zone where the strategy performs consistently well, even as market conditions change. By filtering out outliers and low performers, we hone in on these clusters - our “diamond veins” - ensuring that the investment approach is not only profitable but also resilient against volatility and noise.

“Strength is found not in fleeting brilliance, but in patterns that endure through time and turbulence.”

From Data to Strategy: The Quantelligent Edge

These mined clusters become the foundation of our Quantelligent Algorithm - a smart, adaptive investment strategy built on rigorous quantitative analysis. This isn’t guesswork or gut feeling. It’s a systematic, repeatable process that transforms complex data mining into actionable investment decisions.

By relying on these data-mined “diamond veins”, LymanWealth’s investors gain a stable and optimized strategy designed to weather different market cycles, minimizing emotional biases and maximizing long-term growth.

Conclusion: The Future of Investing is Mining

The worlds of gaming and crypto have familiarized us all with mining - a concept that’s now reshaping the financial industry. At LymanWealth, we leverage this powerful metaphor and technology to turn mountains of market data into a digital treasure hunt for profits.

By embracing LymanWealth’s innovative quantitative mining technique, investors no longer have to rely on guesswork or speculation. Instead, they gain access to rigorously mined, stable strategy clusters, that offer a smart data-driven path to growth.

In today’s complex market landscape, the future of investing is clear: it’s mining - precise, strategic, and powered by deep technical innovation.